PRISM™

Modus’ Proprietary Scoring Algorithm for Underwriting

PRISM™ Scoring Algorithm

Modus’ proprietary scoring algorithm is filed and approved to expedite launches of UBI programs across the U.S.

Ultimate Flexibility

As a client, you will have access to three different scoring model options to choose from:

- PRISM

- Custom-built algorithm based on your criteria

- Our third party partners

You can run your archived data through multiple models simultaneously to test your hypothesis, compare results, or customize the model to best fit your needs. Plus, you won’t have to wait for new data to make a conclusion.

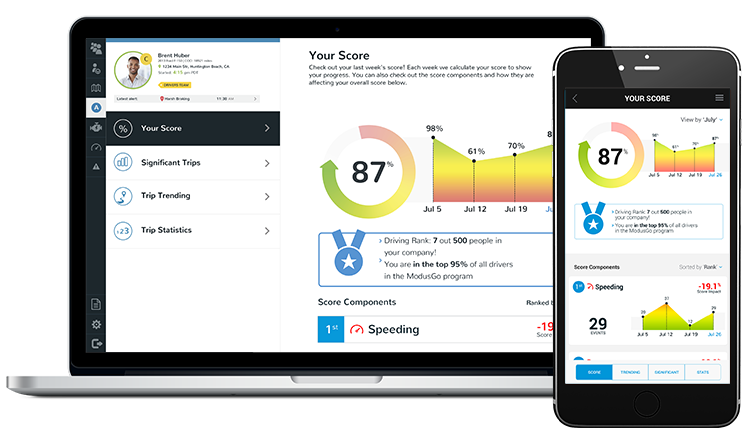

Not Just Your Traditional Driver Scoring

Now your pricing model not only takes into consideration traditional event-based driver behavior, but also contextual data such as phone usage, road type, road conditions, weather, and time of day.

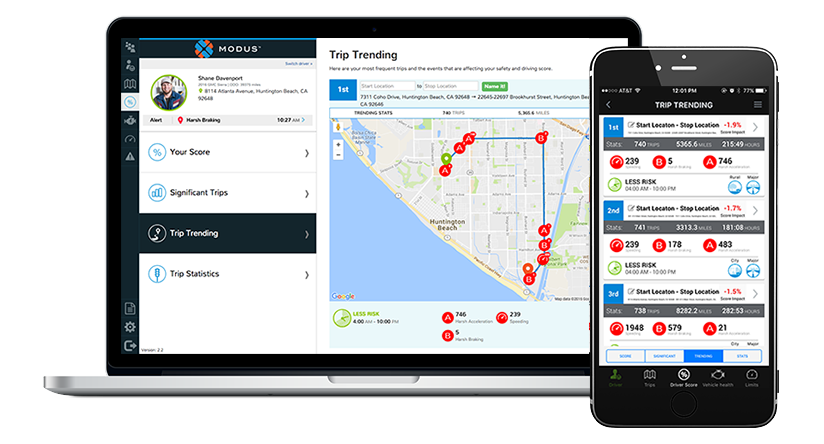

Behavior Trends

Get insight into a policyholder’s repeated negative driving behavior through their most frequently taken trips that have impacted their score over time. In turn, drivers receive actionable insights to help them improve their safety and reduce risk.

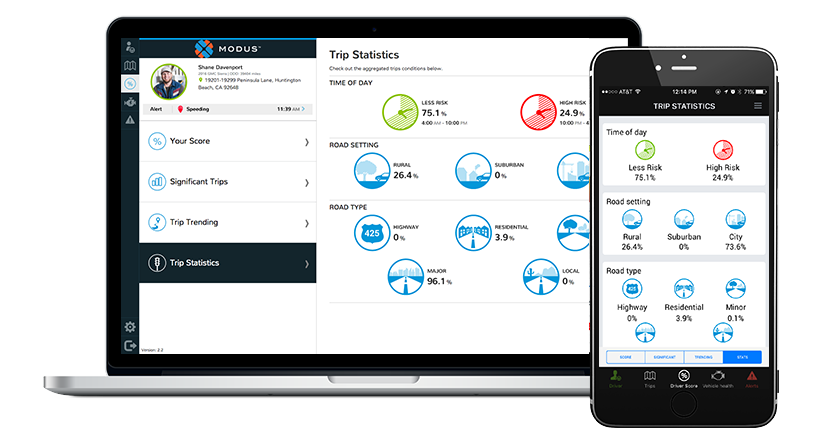

Driving Statistics

Evaluate your policyholder’s driving over time of day, road settings and road type to better understand the context of where they’re spending most of their driving time and under what conditions.

Capture Low Risk Drivers

UBI programs incur the benefit of self selection and inherently attract the low-risk driver segment. Plus, analyze data that builds robust customer segmentation.

PRISM Scoring for Insurance

Learn how you can improve the accuracy of your risk and pricing segmentation.