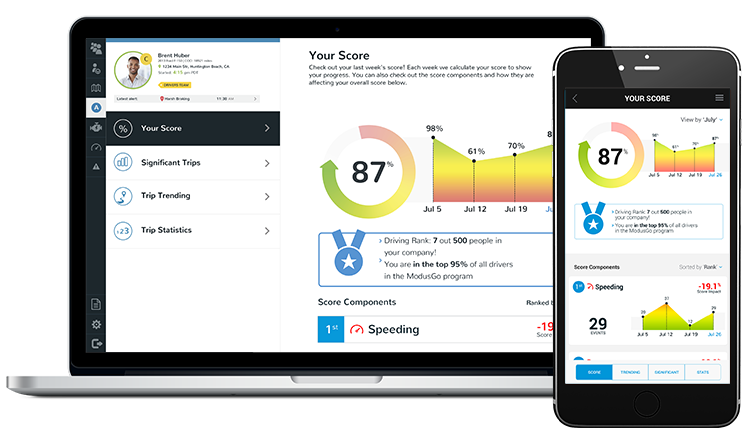

Crash Detection & Data

Insulation from Increased Frequency of Claims

First Notification of Loss & Damage Data

Access to crash data for analysis, reconstruction and claim fact verification.

Improve Your Expense & Loss Ratios

FNOL decreases claims handling cycle time and in turn, expense ratios. UBI programs decrease your loss ratios through targeting and attracting better driving risk profiles.

Claims Efficiency Through Faster Processing Time

Available with some of Modus’ hardware options:

- Automated Crash Report

- Claim Close Time Reduction

- Event Severity

- Crash Data for Analysis

- Crash Reconstruction

- Claim Fact Verification (Fraud Prevention)

- Claims Triage Tool

- Instantly Estimate Damages & Injury

- Occurrence-based Value

Improved Expense Ratio

Based on the last 8 years of crash data logging, Cost of Claims was reduced by 15%. Estimated reduction in Cost of Claims for insurance was at least 20%.

Estimate Damages & Injuries

Imagine having all the data you need to instantly estimate both damages and injury as soon as an accident happens. Benefit from improved reserving and claims efficiency.

Improving Your Bottom Line

Learn how a UBI program can provide you with instant access to crash data for analysis