Modus for Insurance

Because Not All Drivers Are Created Equal

Modus for Insurance

Because Not All Drivers Are Created Equal

With the most innovative, scalable and flexible connected car platform available, Modus delivers actionable driver performance data that enables you to identify and characterize more accurate risk profiles, and improve pricing and profitability across your entire portfolio.

Modus provides the most reliable, predictive data available to target, attract and retain drivers with pricing based on how drivers actually drive.

We will guide you each step of the way:

Towers Watson*

Allianz**

Ageas**

Zurich**

*Source: TowersWatson, “The Future Insurance Data and the Customer Relationship”, Connected Car Insurance USA 2016, Chicago

**Source: SOA Actuarial Seminar, Long Term, Auto, General Insurance; Seoul, South Korea; Nov. 16, 2015; David Dou, FCAS

Deploy Modus efficiently to all of your customers.

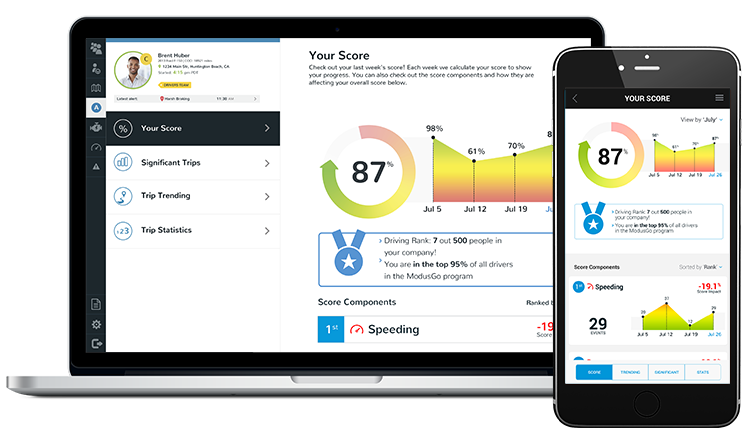

Differentiate your brand and delight your customers with leading technology.

Use Modus out of the box, or tailor it to your exact specifications.

Reinforce and incentivize good driving behavior to reduce portfolio risk.

Invest in a platform designed to adapt to future technology.

Collect and analyze behavioral data to uncover portfolio insights and better understand risk.

You’re connected car insurance solution is in expert hands:

With an instantly scalable cloud-based platform, open architecture and indefinite data maintenance, Modus is able to deploy your program quickly in multiple geographies simultaneously.

What more could you ask for?

Property Casualty 360 – Auto claims face a bumpy road ahead

Neilsen – UBI is gaining traction among millennials

IHS Markit – UBI Expected to Grow to 142 Million Subscribers Globally by 2023

Edmunds – How to Tell if Usage-Based Car Insurance is Right for You

Property Casualty 360 – Designing a UBI program for the ‘average Joe’ – and anyone else

Insurance Networking News – Insurers Should Take a Demographic Approach to UBI: LexisNexis

JD Powers – Customers Value First Notification of Loss as a Service

Insurance Journal – Usage-Based Auto Insurance, Slow at First, Picking up Speed

National Association of Insurance Commissioners – UBI and Vehicle Telematics: Insurance Market & Regulatory Implications

National Association of Insurance Commissioners – UBI Poised for Rapid Growth in the U.S.

Discover how insurers rely on Modus to better understand their customers and portfolio, reduce overall risk, deliver more value, and incorporate actual behavioral data, ratings, and risk into pricing.