Industry-leading connected car insurance solutions built to attract new customers,

Target The Best Drivers For Your Program

With the most innovative, scalable and flexible connected car platform available, Modus delivers actionable driver performance data that enables you to identify and characterize more accurate risk profiles, and improve pricing and profitability across your entire portfolio.

Smarter Acquisition and Retention

Modus provides the most reliable, predictive data available to target, attract and retain drivers with pricing based on how drivers actually drive.

We are Experts at Running UBI Programs

We will guide you each step of the way:

- Quality Assurance

- Dedicated Modus Account Manager

- Production Support

- Monitoring

- Deployment

Why Modus?

Skilled in Operations & Logistics

You’re connected car insurance solution is in expert hands:

- Extensive Quality Control Testing

- Program Management Tools

- Web Services Integration

- Highly Scalable Data Hosting

- Customized Analytics

- Key Performance Indicators

Flexible, Fast Implementation

With an instantly scalable cloud-based platform, open architecture and indefinite data maintenance, Modus is able to deploy your program quickly in multiple geographies simultaneously.

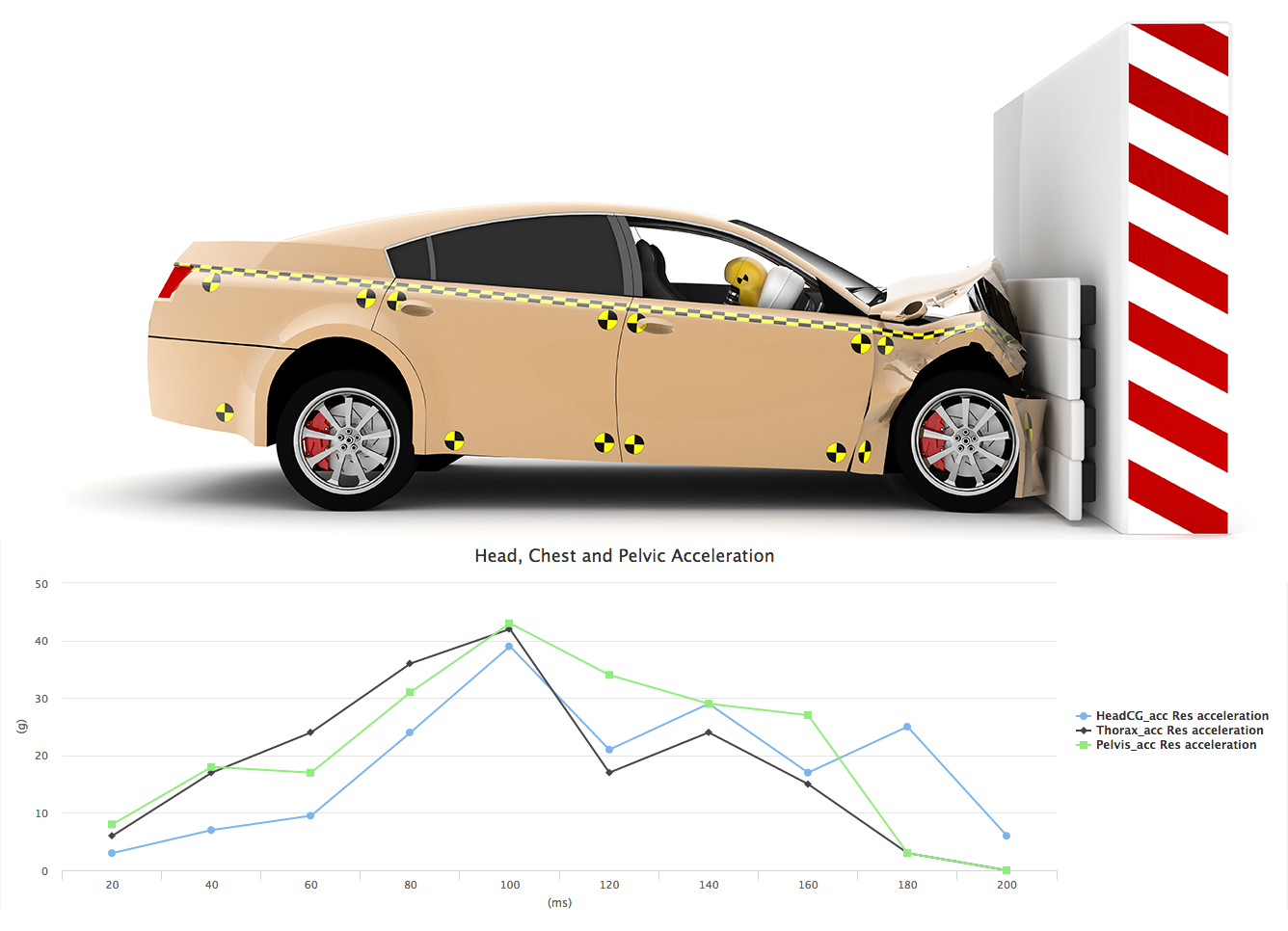

Crash Detection and Data

Get instant access to crash data that affects your bottom line.

End-to-End Solution

What more could you ask for?

Don’t Just Take Our Word for It; Industry Experts Agree UBI Helps Insurers Target Safer & More Profitable Risks

Property Casualty 360 – Auto claims face a bumpy road ahead

Neilsen – UBI is gaining traction among millennials

IHS Markit – UBI Expected to Grow to 142 Million Subscribers Globally by 2023

Edmunds – How to Tell if Usage-Based Car Insurance is Right for You

Property Casualty 360 – Designing a UBI program for the ‘average Joe’ – and anyone else

Learn about Modus for Insurance

Discover how insurers rely on Modus to better understand their customers and portfolio, reduce overall risk, deliver more value, and incorporate actual behavioral data, ratings, and risk into pricing.